SIP Calculator

🔍 Why You Need an SIP Calculator—And How to Use It in the Global Market

🚀 Take Control of Your Wealth—One SIP at a Time

In a world where every click can lead to an impulse buy, imagine having a tool that ensures your money is working for you. That’s where an SIP (Systematic Investment Plan) calculator comes in—it transforms vague financial goals into concrete, achievable investment strategies.

Think of it as Google Maps for your finances—enter your investment target, and the SIP calculator charts the smartest route based on market conditions, expected returns, and disciplined investing.

📌 1. Why Use an SIP Calculator?

🎯 See Your Financial Future Clearly

Let’s say you invest $300 per month for 15 years in the U.S. stock market with an expected 8% annual return. Instead of hoping for the best, an SIP calculator will show that your investment could grow to over $118,000—thanks to the magic of compound interest.

📊 Graphic Idea: A chart showing SIP investment growth over time:

- X-axis: Years

- Y-axis: Portfolio Value

- Highlighted Points: “Today,” “5 Years – $22K,” “10 Years – $66K,” “15 Years – $118K”

🧠 Plan with Precision

Want to save $50,000 for a home down payment in 10 years? The SIP calculator reverse-engineers your goal and shows you:

✅ Invest $350/month in diversified U.S. ETFs or mutual funds with an 8% return, and you’ll hit your target.

💡 Pro Tip: Investing systematically beats market timing—stick to the numbers, and watch your investments grow.

🔄 Compare Multiple Scenarios

Wondering how market fluctuations impact your SIP? The calculator lets you test:

- Increasing monthly SIP contributions by 5% annually

- Market downturns and recovery periods

- Adding a lump sum of $5,000 midway through your investment

📊 Graphic Idea: Side-by-side comparison chart of different SIP strategies.

💪 Stay Disciplined & Build Confidence

When you see your investments growing over time, it reinforces smart financial habits. Instead of reacting to market noise, you stay committed to your plan—because real wealth is built through consistency, not speculation.

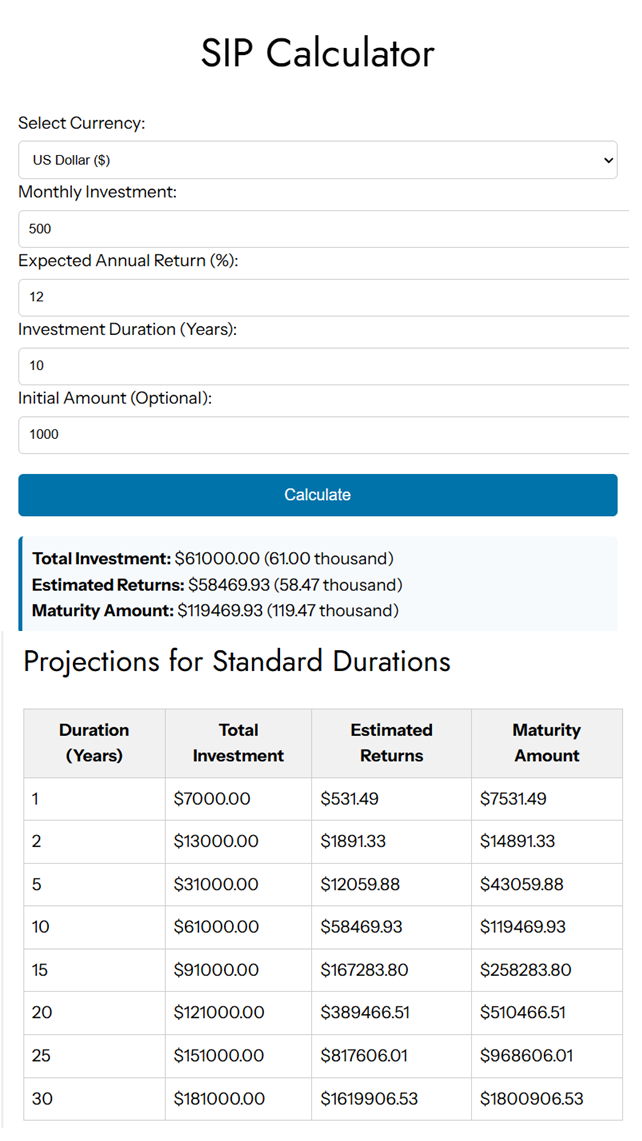

🧮 2. How Does an SIP Calculator Work?

📝 You Input:

- Monthly Investment: e.g., $300

- Expected Return: e.g., 8% annually (U.S. stock market average)

- Time Frame: e.g., 15 years

🔢 It Calculates Using Compound Interest: $$\text{Future Value} = P \times \frac{(1 + r)^n – 1}{r} \times (1 + r)$$ Where:

- P = Monthly investment

- r = Monthly rate of return (annual ÷ 12)

- n = Number of months

⚡ Instant Results:

- Total Invested

- Wealth (Including Gains)

- Total Profit Earned

🧭 3. How to Use an SIP Calculator?

1️⃣ Visit: sipcalculatorfree.com 2️⃣ Enter Your Inputs:

- Monthly SIP: $300

- Expected Return: 8%

- Duration: 15 years 3️⃣ Customize Your Plan:

- Add one-time lump sum investments

- Increase SIPs annually 4️⃣ Hit Calculate:

- Interactive charts + clear breakdown of wealth projections 5️⃣ Save & Share:

- Download a detailed investment report (PDF)

- Share via Email or WhatsApp

📊 Graphic Idea: A simple flowchart: Enter Data → Customize → View Results → Save/Share

💡 4. Pro Tips for Maximizing SIP Growth

✅ Start Early: Investing $200/month at 25 beats $400/month at 35 due to compound growth. ✅ Step Up Contributions: Increase SIP by 5-10% yearly to keep pace with inflation. ✅ Diversify Globally: Mix U.S. ETFs, emerging markets, and fixed-income funds to balance risk. ✅ Review Annually: Adjust your SIP based on changing market conditions and personal goals.

📈 Example Investment Scenarios:

| Age Started | Monthly SIP | Years | Final Corpus |

|---|---|---|---|

| 25 | $200 | 30 | $450,000 |

| 35 | $400 | 20 | $220,000 |

🔍 Lesson: Starting earlier wins—even with smaller contributions!

🌱 5. Ready to Take Charge of Your Financial Future?

Your dreams need a strategy—not just hope. With a free, mobile-optimized SIP Calculator, you can start investing in U.S. or global stock markets confidently—no financial degree required!

👉 Try It Now at sipcalculatorfree.com and take control of your investments—one SIP at a time.

👉 Try It Now at sipcalculatorfree.in Indian Version of Site.

📌 Final Thought:

Every great financial journey begins with a single, strategic step. Start today—invest wisely, build wealth, and secure your future. 🚀