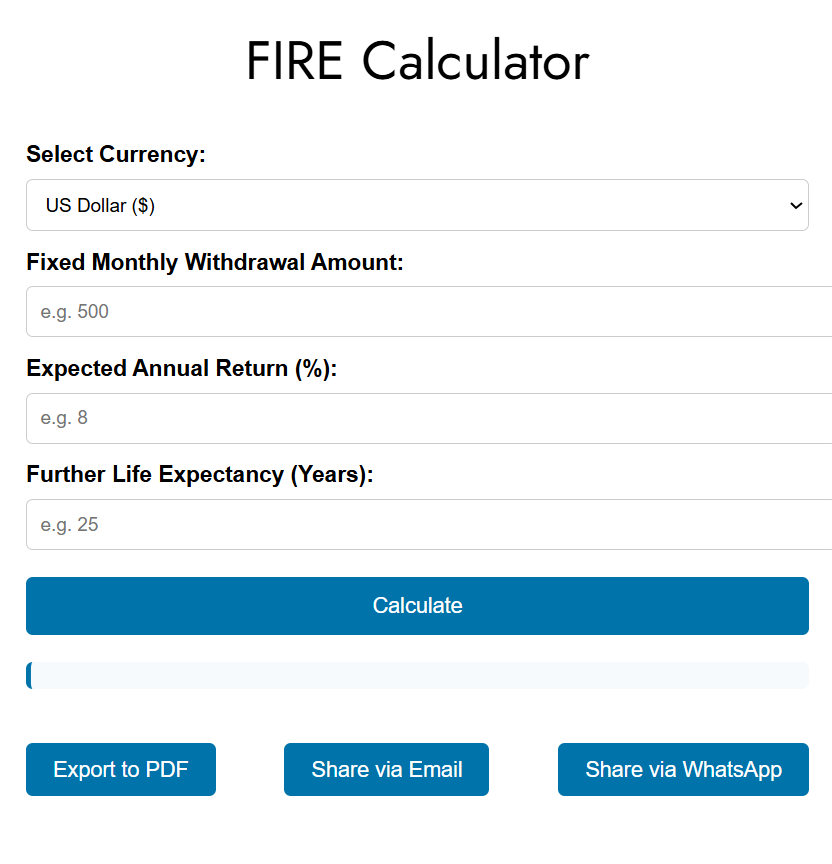

FIRE Calculator

🔥 FIRE Calculator for the US & Europe | Plan Financial Independence with Lumpsum & SWP Strategies

Achieve financial independence and retire early (FIRE) with confidence using our advanced FIRE Calculator, tailored for investors in the United States, Germany, France, UK, and across Europe. Designed for international standards, our tool estimates how much corpus you need to support your lifestyle post-retirement.

🔎 Also explore:

- SIP Calculator – For monthly investment planning

- SWP Calculator – For sustainable withdrawal planning

- Lumpsum Investment Calculator – For one-time growth projections

🔥 What is the FIRE Calculator?

Our FIRE (Financial Independence, Retire Early) Calculator estimates the retirement corpus required to sustain fixed monthly withdrawals over your expected lifespan—factoring in projected investment returns. Whether you're based in New York or Berlin, this tool helps map your path to early retirement.

💼 Why Use Our FIRE Calculator?

✅ Precision-Based Retirement Planning

✅ Visualize Corpus Depletion Over Time

✅ Multi-Currency Support (USD, EUR, GBP, INR, JPY)

✅ Real-Time Results

✅ Export & Share with Financial Advisors

📊 Key Features for International Investors

🔹 1. Corpus Estimation with Fixed Withdrawals

Enter your desired monthly withdrawal, expected annual return, and life expectancy—get the total corpus you need for FIRE.

🔹 2. Flexible Currency Selection

Choose from USD, EUR, GBP, INR, or JPY—see realistic projections in your home currency.

🔹 3. Investment Return Adjustments

Simulate scenarios at 5%, 7%, or 10% annual returns to match realistic expectations in different economies.

🔹 4. Time-Series Corpus Depletion Chart

Visual graphs help you understand how your wealth declines over time and when it may run out.

🔹 5. PDF Export & Sharing

Download your plan as a PDF or share it instantly via email or WhatsApp.

🔹 6. Link to Other Tools

Want to combine strategies? Link directly to:

📈 How to Use the FIRE Calculator

Step 1: Select your currency: USD, EUR, GBP, INR, or JPY

Step 2: Input:

- Monthly Withdrawal (e.g., €2,000)

- Expected Annual Return (e.g., 6%)

- Retirement Duration (e.g., 30 years)

Step 3: Get your required FIRE corpus instantly.

Step 4: Analyze the depletion curve and sustainability.

Step 5: Export your plan or share it for review.

🔢 Formula Behind the FIRE Calculation

We use the Present Value of an Annuity formula to determine your retirement corpus: Corpus=Withdrawal×[1−(1+monthlyRate)−months]monthlyRate\text{Corpus} = \frac{{\text{Withdrawal} \times \left[1 - (1 + \text{monthlyRate})^{-\text{months}}\right]}}{\text{monthlyRate}}Corpus=monthlyRateWithdrawal×[1−(1+monthlyRate)−months]

Where:

- Withdrawal = Fixed Monthly Amount

- monthlyRate = Annual Return ÷ 12

- months = Years × 12

This formula ensures your money lasts exactly the number of years you specify—backed by compound math.

🌱 FIRE Examples – Europe & USA

| Age at Retirement | Monthly Need | Return (%) | Duration (Years) | Required Corpus |

|---|---|---|---|---|

| 35 (Germany) | €2,000 | 6% | 40 | €511,000 |

| 40 (USA) | $3,000 | 7% | 35 | $567,000 |

| 45 (France) | €2,500 | 5% | 30 | €479,500 |

👉 Pair this with a Lumpsum Investment Plan to reach your FIRE number faster.

💬 Final Thought

Wherever you are in your FIRE journey—just starting out or refining your exit strategy—our FIRE Calculator puts financial independence within reach. No fluff. No ads. Just precision-built tools to secure your future.

👉 Ready to take control?

Try the FIRE Calculator now and pair it with our full suite of financial tools on sipcalculatorfree.com.

Also Checkout other site wikipedia site What is lumpsum investment.